Specialized Property Management

Predictive Trend Analyst

Transform DFW real estate decisions with advanced predictive analytics. Anticipate market shifts, identify opportunities, and optimize your portfolio with data-driven intelligence.

Predictive Analytics

Q1-Q4 2026 market forecasts

Multi-Lens Analysis

3 analytical perspectives

Real-Time Metrics

DFW market intelligence

Executive Dashboard

DFW Market Intelligence • January 2026

Inventory Trend (YoY Comparison)

Days on Market by Zip Code

County Analysis (Collin, Denton, Kaufman)

Multi-Perspective Analysis

Three distinct analytical lenses for comprehensive market understanding

Predictive Timeline

Quarterly phase progression with market impact analysis

Strategic Indicators

Key metrics for monitoring market health and risk levels

Investment Calculators

Analyze potential investments with professional-grade financial tools

Input Parameters

* Adjust values to see real-time calculation updates

Analysis Results

DFW Market Context: Current average cap rates in DFW range from 5.5% to 7.2% depending on property class and location. Zone A properties typically command 5.5-6.0%, while Zone C offers 6.5-7.2%.

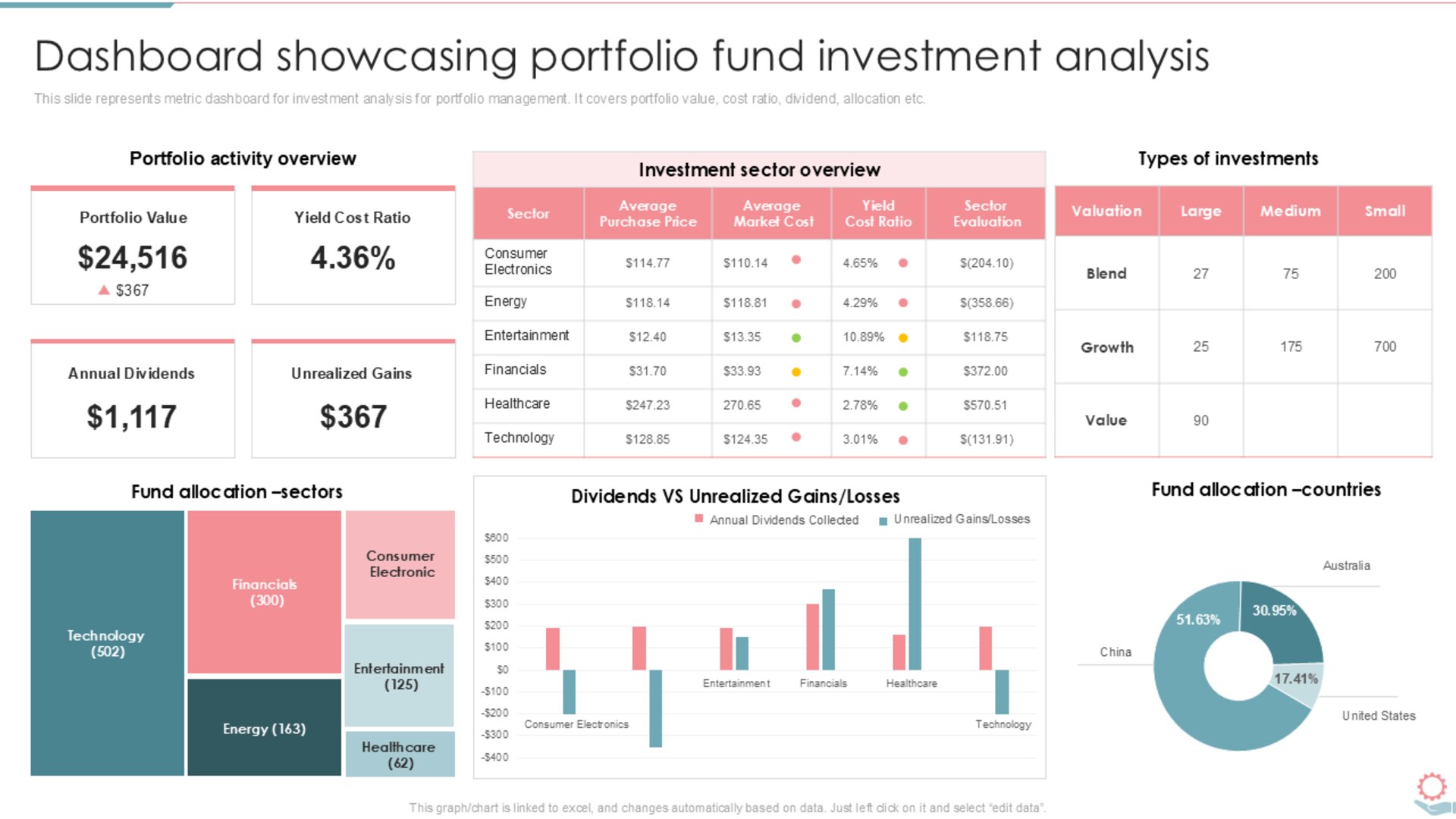

Competitive Analysis

How Specialized PM performs against DFW market competitors

Avg Rent

$2150

Occupancy

94.2%

Days on Market

18 days

Tenant Rating

4.6/5

Mgmt Fee

8%

DFW Property Management Competitive Landscape

| Company | Market Share | Avg Rent | Occupancy | Days on Market | Tenant Rating | Mgmt Fee |

|---|---|---|---|---|---|---|

Specialized PMYou | 8.5% | $2150 | 94.2% | 18 days | 4.6/5 | 8% |

Competitor A | 12.3% | $1980 | 91.5% | 24 days | 4.1/5 | 10% |

Competitor B | 9.8% | $2050 | 92.8% | 21 days | 4.3/5 | 9% |

Competitor C | 7.2% | $1890 | 89.4% | 28 days | 3.8/5 | 8.5% |

Market AverageBenchmark | 6.1% | $1950 | 90.5% | 25 days | 4/5 | 9.5% |

Competitive Advantages

- • Highest average rent achieved (+10% vs market)

- • Best occupancy rate in competitive set

- • Fastest lease-up time (18 days)

- • Highest tenant satisfaction score

Growth Opportunities

- • Market share expansion potential: +5%

- • Underserved ZIP codes: 75126, 75067

- • Premium positioning justifies fee increase

- • Accidental landlord segment untapped

Strategic Position

- • "Efficiency Expert" positioning validated

- • Data-driven approach differentiates

- • Premium service commands premium pricing

- • Technology stack creates moat

Predictive Trend Analyst

Ask complex market questions and get data-driven insights powered by advanced AI

Try these example queries by category:

SPM Predictive Analyst

AI Assistant • Online

Powered by advanced language models trained on DFW market data

Scenario Walkthroughs

Experience the question → analysis → recommendation flow

Market Intelligence Report

Generate professional PDF reports for stakeholders and decision-makers

DFW Market Intelligence Report

Specialized Property Management

Report ID: SPM-2026-Q1-001

Executive Summary

The DFW single-family rental market is experiencing a significant transition phase characterized by a 32% YoY inventory increase. This shift, driven by institutional liquidation and accidental landlord growth, presents strategic opportunities for well-positioned property managers. Key thesis: "DFW is re-retailing, not crashing."

Key Market Indicators

Active Listings

8,400+

+32% YoY

Institutional Ownership

15-18%

Liquidating

Mortgage Rates

~6%

Fannie Bond Program

Employment Growth

89K jobs

Added 2025

Avg Days on Market

42 days

+8 vs 2024

Avg Rent

$2,150

-2.3% YoY

Multi-Perspective Analysis

Bearish View: Institutional Liquidation Risk

Invitation Homes and American Homes 4 Rent selling 5-10% of DFW holdings. Shadow inventory could extend rent compression through Q3.

Bullish View: Job Growth Floor

89K jobs added in 2025 with Toyota, Samsung, and PGA expansions creating demand floor. Absorption should accelerate Q2-Q3.

Opportunity: Accidental Landlord Surge

45% of new listings from owner-occupants unable to sell. This segment needs professional management and represents acquisition opportunity.

2026 Predictive Timeline

Strategic Recommendations

- 1Position as "Efficiency Expert" - focus on operational excellence during market softness

- 2Target accidental landlord segment for portfolio growth (45% of new inventory)

- 3Monitor ZIP codes 75126 (Forney) and 75067 (Lewisburg) for strategic acquisitions

- 4Prepare for Q4 institutional re-entry by building capital reserves

- 5Lock in quality tenants during Q2 rent compression window

Specialized Property Management

Predictive Trend Analyst • DFW Market Intelligence

Generated: January 14, 2026

Confidential - For Internal Use Only

Key Takeaway

"DFW is re-retailing, not crashing."

Strategic positioning as "Efficiency Expert" wins in this market.

Predictive Intelligence

Anticipate market shifts before they happen with AI-powered forecasting

Multi-Lens Analysis

Evaluate opportunities through bearish, bullish, and opportunity perspectives

Actionable Insights

Convert data into specific recommendations for portfolio optimization

What You Get

- Real-time DFW market dashboard

- Quarterly predictive timeline

- Multi-perspective risk analysis

- Strategic indicator monitoring

- AI-powered Q&A assistant

- Scenario-based decision support

© 2026 Specialized Property Management • Predictive Trend Analyst

Powered by advanced AI • DFW Market Intelligence